Credit Tenant vs. Non-credit Tenant When Buying an NNN Property

Real estate investors looking for passive income opportunities with minimal management often look for triple-net (NNN) properties. If you’re a real estate investor looking to invest in NNN properties, a key part of understanding the NNN lease is to understand the tenant’s credit (investment grade) and financials. A tenant’s credit rating and financials are what influence the strength of your property and its value, which also affects your returns and the ability to get financing.

Generally, NNN property means that the tenant is responsible for the property’s maintenance and its expenses, such as taxes and insurance. We’ll explore the key points you need to know when investing in a NNN property to help you maximize your investment returns and leverage on availability.

Understanding the Tenant Credit Rating When Buying an NNN Property

When purchasing NNN properties, you need to understand how the credit rating affects your triple-net investment. In a triple-net (NNN) lease, the tenant assumes the responsibility for the ongoing operating costs of the property, in exchange for a long-term lease. While the NNN leases offer tremendous benefits, there are several risks involved, like in any other investment. That brings the need to calculate the risk of the NNN lease, which partly relies on the quality of the tenant. And to understand the quality of your tenant, you also need to understand their NNN financing or credit rating.

The NNN Financing: What are Credit Ratings, and How Can You Determine Them?

A credit rating of a tenant is the financial strength and the likelihood of the tenant to fulfill their payments and responsibilities throughout their lease time. It works much like a credit score because it determines how much financing you can get, the rates, and the terms or conditions.

The capability of a tenant to make or clear the lease payment helps in making the mortgage payment of the subject property. Therefore, finding the best partner to lend your property given the property type, the tenancy, and location is essential if you want to maximize a NNN property investment. The NNN investments often attract real estate owners or more sophisticated investors that use leveraging large down payments to help grow their portfolios.

So, how exactly are credit ratings determined? You can determine a credit rating by one of the major credit agencies, which are Moody’s Investor Service, Fitch, and Standard and Poor’s (S&P). Overall, ratings can be categorized into non-investment grade and investment grade. As the owner, it’s your responsibility to review the tenant’s credit and ensure that they carry ratings with the lowest risk.

The Leasing Information of an NNN Property

Most NNN properties that lease with credit tenants often have an initial lease term of about 10-15 years, with periods of national credit tenants extending to about 25-30 years. A longer credit tenant lease makes the investment more attractive for an existing landlord or even a prospective purchaser. For an NNN leased property with long and short-term leases in place, you must work with industry experts that can help you get competitive loan terms to offer long-term and flexible options.

Credit Tenant vs. Non-credit Tenant

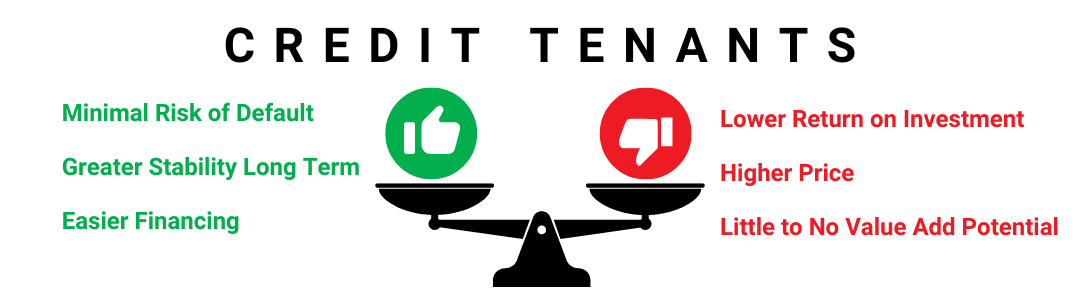

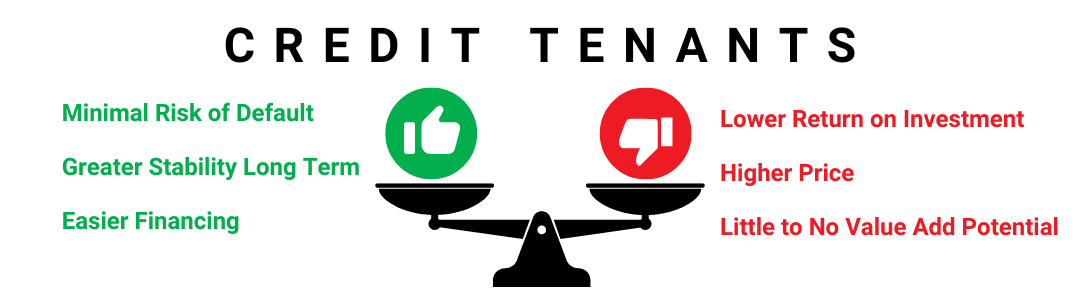

A tenant’s financial strength is a crucial characteristic as it will affect the value, and ultimately the return and financial availability. How much risk will you be exposed to, especially in the event of an economic downturn? It’s worth noting that risks correlate with rewards, meaning that a credit-tenant leased property is likely to be higher-priced. It also tends to offer a lower return on investment compared to a non-credit tenant leased property.

Who are Credit Tenants, and Why Invest in Credit Tenant Properties?

Credit tenants, sometimes called investment grade tenants, include companies with investment-grade ratings either by one or more of the three major credit agencies: Moody’s, Fitch, and Standard & Poor’s. Such large, public agencies are financially strong and, therefore, pose a low default risk.

But why should you invest in credit tenant properties? Minimal maintenance, stable tenants, and high occupancy rates are the main reasons why some investors choose credit tenant properties. Properties with a brand-name or national credit tenants often provide a long-term income stream with minimal risk. So, when your NNN property is occupied by a credit tenant, expect to pay for the stability convenience because as much as your ROI will be lower, you’ll still be more guaranteed.

Who are Non-credit Tenants, and Why Invest in Non-credit Tenant Properties?

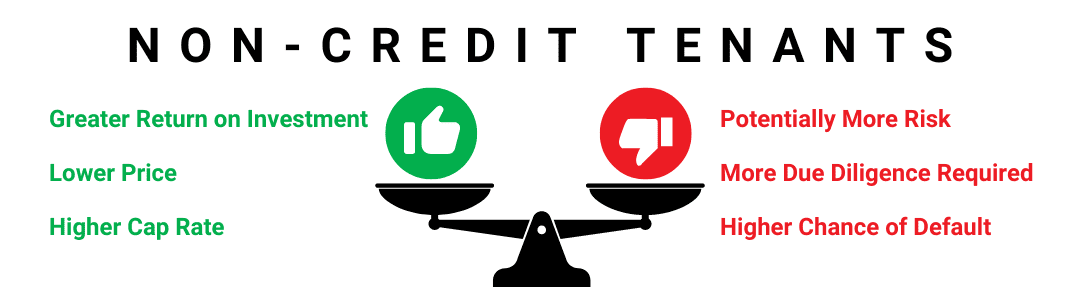

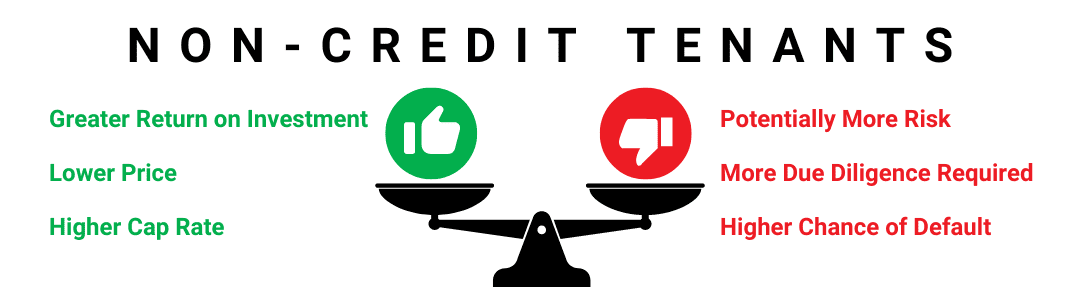

Non-credit tenants are typically private, local, small, or regional businesses, franchises, and manufacturers that don’t operate from a national level. Unlike the large traded companies, non-credit tenants are often smaller in their total revenues, and might not be publicly rated by the major three commercial credit agencies.

However, it’s important to note that being small does not make the non-credit tenant bad investments, but you should perform additional due diligence when assessing the long-term viability of the non-credit tenants. While non-credit tenants have a higher risk and are not as financially stable as credit tenants, investors can get properties at a lower price, higher cap rate, and overall greater investment return. Typically these investments have a personal guarantee from the tenant.

How Does Tenant Credit Determine Property Evaluation?

As we said earlier, the financial strength of a tenant is subject to the price of the property, meaning it also affects your financing availability and the ROI. Single tenant investments are different from other real estate investments in how the loan-to-value ratio gets determined. One of the main factors that help calculate the loan-to-value ratio is a tenant’s creditworthiness, closely followed by the property location, length of the lease, and rent increase over the lease term.

Lastly, are Your Prospective Credit Tenants Creditworthy?

Generally, any investment has its risks, so there’s no such thing as an investment being “risk-free”. As you search for a property, every prospective NNN property investment will require an up-front and in-depth evaluation such as risk analysis, the creditworthiness of the tenant, and the return on investment. Bear in mind that when you have a strong franchise or an investment-grade tenant, you’ll enjoy a low-risk and reliable investment that will provide a steady income.

If you’re a beginner searching for a potential NNN property investment in Northern Virginia, consider connecting with Serafin Real Estate and obtain expert help that will help you through the entire process. We’ll also save you from making a possible financial mistake that could otherwise happen.